What is Rule of 72 ?

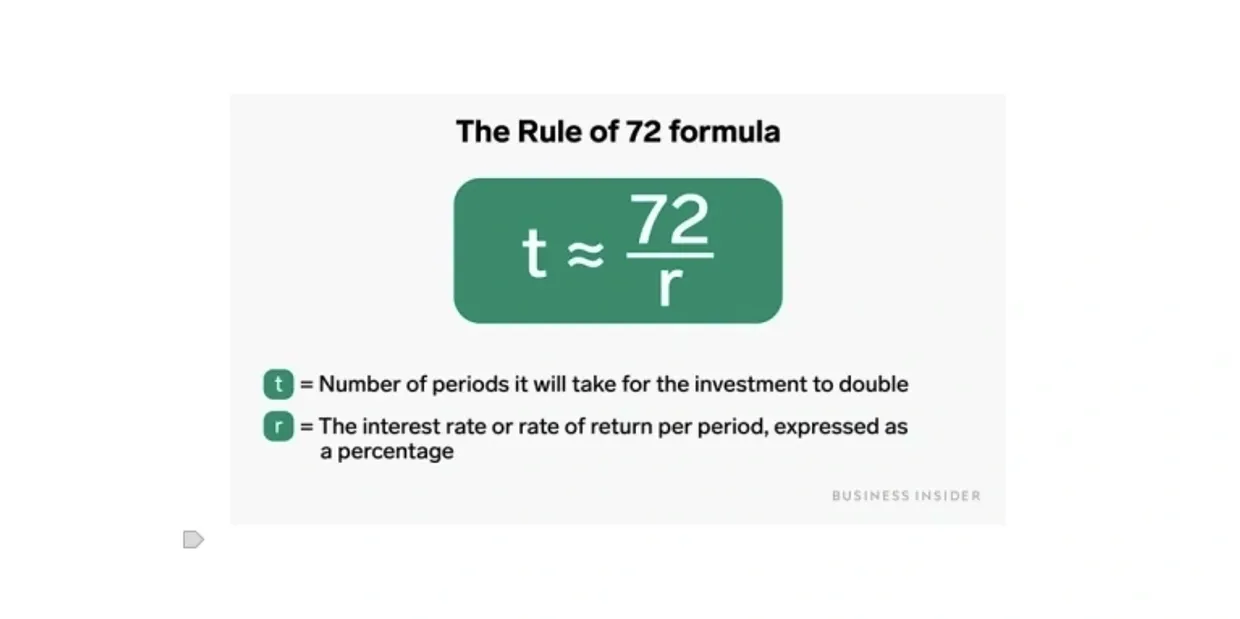

The Rule of 72 is a mathematical principle that estimates the time it will take for an investment to double in value.

To calculate the Rule of 72, all you have to do is divide the number 72 by the rate of return. You can use the formula below to calculate the doubling time in days, months, or years, depending on how the interest rate is expressed.

For example, if you input the annualized interest rate, you’ll get the number of years it will take for your investments to double.

While usually used to estimate the doubling time on a growing investment, the Rule of 72 can also be used to estimate halving time on something that’s depreciating.

For example, you can use the Rule of 72 to estimate how many years it will take for a currency’s buying power to be cut in half due to inflation, or how many years it will take for the total value of a universal life insurance policy to decline by 50%. The formula works exactly the same either way — simply plug in the inflation rate instead of the rate of return, and you’ll get an estimate for how many years it will take for the initial amount to lose half its value.