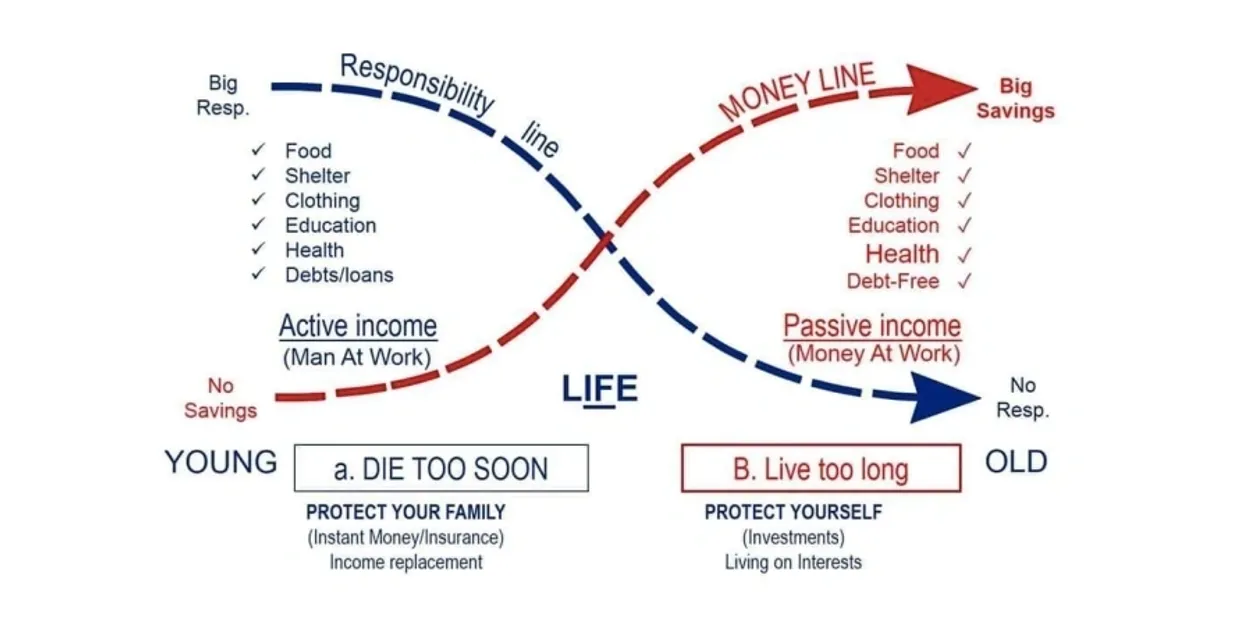

The X-Curve concept is a simple way to show the relationship between taking care of your responsibility while building your wealth. This concept theorizes that in general a person’s responsibility decreases and their wealth increases over time.

In life, 2 outcomes can happen to you: Either you live too long or you die too soon. In any event, you should protect yourself and your family’s future.

- Have high protection when you are younger. It will take care of your family-children, college education, mortgage, debts – if something happens to you.

- Save as much as you can to take care of your future.

When you’re younger, you normally don’t have money. Then you start to save and invest.

- As you build up your wealth, the wealth curve rises. Hopefully, when you get older, you have enough money for your retirement.

- The wealth curve is your investment curve.

However, when you are younger and start a new family, you may have high responsibilities for:

- Children,

- Mortgage,

- College/university saving,

- Debts.

You and your spouse may be responsible for these obligations whether you live or die.

Early on, the need for insurance protection is quite high.

- But as your children grow up,

- your mortgage matures,

- you reduce your debt,

- your responsibility will decrease.

The X-Curve provides a clear approach for building your financial foundation. You’ll be motivated to save, invest, and accumulate your assets faster, so you can reduce your debt, mortgage and retirement, fulfilling your responsibility and reducing your insurance needs.