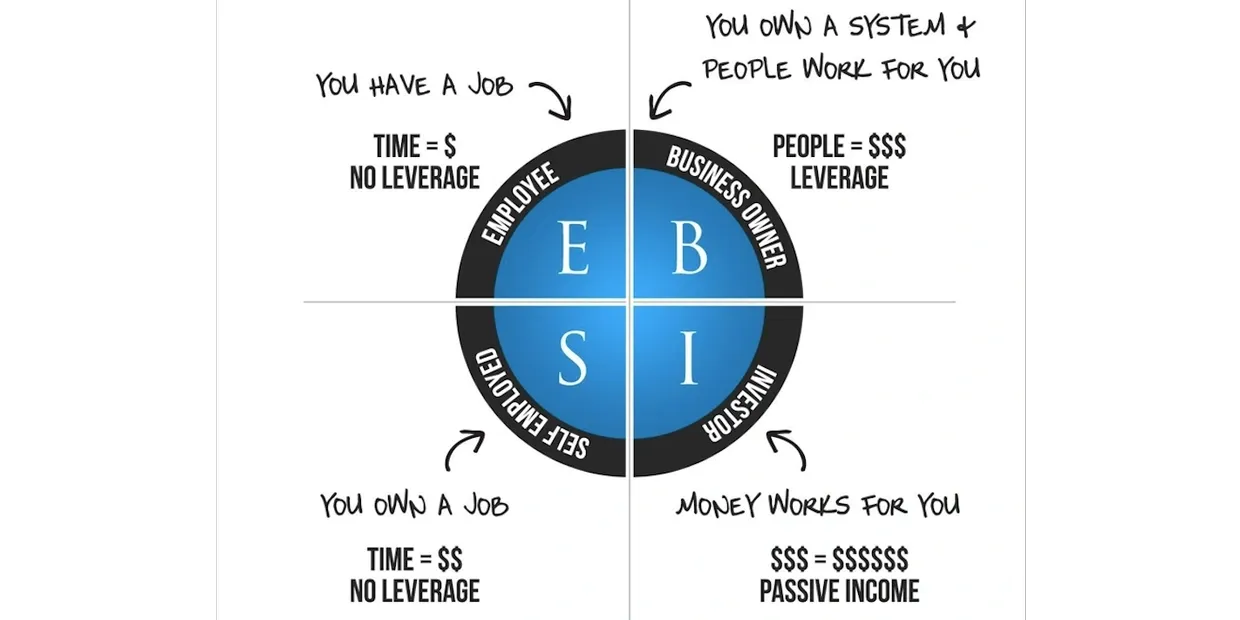

Let us delve a little deeper into these terms…

E – Employee:

An employee has a job. This is where most people earn their income. The job itself is owned by a business, which could be a single person or a large corporation. The employee gives his or her time, energy, and skills to an employer in exchange for a pay check and benefits.

Employees can make a little or lot of money. But when an employee stops working (or when the business stops), the income stops, too.

An employee’s financial destiny, security, and freedom is dependent upon the whim and the success of their employer.

S – Self-Employed:

Many employees get tired of their lack of control and choose to work for themselves. The self-employed still work, but they own their job.

Self-employed people do have a lot more control than an employee, but that also means they have more responsibility. As a result, success usually means working harder and working longer. Over the long run this can lead to burn out and fatigue.

B – Business Owner:

Those in the B quadrant own a system and lead people. The systems and people who work for the business can run successfully without the business owner’s constant involvement.

I – Investors

Investors own the assets that produce income. This quadrant represents passive income.

Investors in this quadrant have usually accumulated money earned in one or more of the other three quadrants, and they let the money go to work and produce even more money for themselves.

There are multiple paths to Financial Freedom, and most of them ultimately lead to the right side of the quadrant – B and I.

So, if you want to achieve greater financial independence and freedom, start by learning and enhancing skills to move to the right side.

Note:

Operating cash flow is the money that flows in and out of your business from day-to-day operations.

This includes things like revenue from sales, payments to suppliers, and employee salaries.

It’s important to track your operating cash flow so that you can see how much money your business is bringing in and where it’s being spent.